How much does a ‘comfortable’ retirement cost?

From time to time we see tables published exploring how much we need in the way of an annual income in retirement to be able to enjoy our senior years. Here are the latest conclusions.

Pensions and Lifetime Savings Association

One analysis can be found in the Retirement Living Standards, published by the Pensions and Lifetime Savings Association.

Its estimates published in February 2024 said that a single person would need:

- £14,4000 for a minimum living standard

- £31,300 for a moderate living standard

- £43,1000 for a comfortable living standard

A couple would need:

- A joint income of £22,400 for a minimum living standards

- £43,000 for moderate

- £59,00 for comfortable

This is a pretty major jump from late in 2023, where the Association predicted that that a single person would need

- £12,800 a year to achieve the minimum living standard

- £23,300 a year for moderate

- £37,300 a year for comfortable

And for couples:

- £19,900 a year for a minimum living standard

- £34,000 for moderate

- £54,500 for comfortable

What do those terms mean?

The Association has put flesh on the bones around what a single person can actually expect for those levels of income.

| Minimum | Moderate | Comfortable | |

| Standard of living | Covers all your needs, with some left over for fun | More financial security and flexibility | More financial freedom and some luxuries |

| House | DIY £100 maintenance and decorating one room a year | Some help with maintenance and decorating each year | Replace kitchen and bathroom every 10/15 years |

| Food | Around £50 a week on groceries, £25 a month on food out of the home, and £15.fortnight on takeaways | Around £55 a week on groceries, £30 a week on food out of the home, £10 a week on takeaways, £100 a month to take others out for a monthly meal | Around £70 a week on food, £40 a week on food out of the home, £20 a week on takeaways, £100 a month to take others out for a monthly meal |

| Transport | No car, £10 per week on taxis, £100 per year on rail fares. | 3 year old small car, replaced every 7 years, £20 a month on taxis, £100 per year on rail fares | 3 year old small car, replaced every 5 years, £20 a month on taxis, £200 per year on rail fares. |

| Holidays and leisure | A fortnight 3* all inclusive holiday in the Med and a long weekend break in the UK. Basic TV and broadband plus two streaming services. | A fortnight 4* holiday in the Med with spending money and 3 long weekend breaks in the UK. Extensive bundled broadband and TV subscription. | |

| Clothing and personal | Up to £630 for clothing and footwear each year | Up to £1,500 for clothing and footwear each year | Up to £1,500 for clothing and footwear each year |

| Helping others | £20 for each birthday and Christmas present. £50 annually for charity | £30 for each present. £200 charity. £1,000 for supporting family members e.g. paying for grandchildren activities. | £50 for each present. £25 per month charity donation, £1,000 family support. |

Minimum Income Standard

The Retirement Living Standards are based on research by the social policy group at Loughborough University on the Minimum Income Standard (MIS), which produces budgets for different household types, based on what members of the public think is needed for a minimum acceptable standard of living in the UK.

This minimum is about having what’s needed to have the opportunities and choices necessary to participate in society. The study cites a participant who said: ‘Food, clothes and shelter keep you alive, but that’s not living’.

MIS describes in detail what households require to meet material and non-material needs to live with dignity, creating baskets of goods and services that combine to provide an adequate living standard. The group then calculate how much different households need to spend to reach this level, and the income required to enable this spending.

Plans vs reality

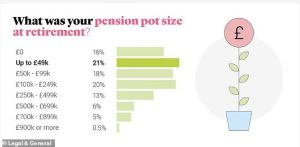

L&G conducted a survey of retired people 50+ across the UK, and found that the average pension pot was just over £185,000, while the Office of National Statistics published a figure in 2020 that was close to £107,000. These numbers are almost certainly out of date now in Spring 2024.

As a result, people have had to adapt their plans. For one thing, those who were thinking of retiring early, or had already done so, needed to rethink whether this makes financial sense.

At the same time, retirees are re-evaluating their priorities. According to the L&G survey, retired people were less likely to take holidays, but were spending more time on hobbies and spending time with families.

What to do next?

It looks like we need to manage our expectations carefully when it comes to retirement living. The figures we’ve looked at in this article don’t even begin to cover the potential cost of care – or private medical treatment when the NHS isn’t available to help.

There is plenty of advice available on the internet for those who still have time to adjust their pension contributions to cover future needs. For those who are now reaching retirement, here are a couple of articles that might help and again, financial experts have posted more if you search for it.

Photo by Unsplash